How To Build financial security in 2026.

Here is the case for simple money moves you should be taking for a prosperous lifestyle in 2026.

Financial progress often stalls because people overcomplicate it. A few straightforward decisions can carry most of the weight, especially for everyday earners who want steadier footing without turning money into a full‑time hobby.

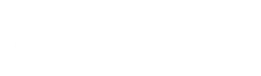

Three moves stand out for 2026: use a high‑yield savings account for cash you won’t touch, fund a Roth IRA for tax‑smart growth, and build a reliable emergency fund. They’re boring by design. They also work.

Think of this as a basic financial operating system. Cash earns something while it waits. Long‑term dollars compound without tax drag. Surprises don’t knock you off course.

This is the foundation for you to learn how to build financial security in 2026

Small steps compound. Learn more about The Simple Path To Wealth here.

High yield savings made practical

How these accounts work and why rates are higher

A high‑yield savings account (HYSA) functions like a standard savings account with the same basic features: deposits, withdrawals, and FDIC or NCUA insurance when held at eligible institutions. The difference is the annual percentage yield (APY) paid on balances.

Why the higher APY? Providers that operate primarily online often have lower overhead and compete directly on rate. They adjust APYs more frequently as market conditions change, so the yield floats. Even with recent rate shifts, many HYSAs still pay roughly 3% to 3.5% APY for idle cash, which beats the near‑zero rate still found at many traditional accounts.

Interest generally compounds monthly. There are usually no minimums, though some banks use tiers. Transfers to and from checking are typically free, with standard ACH timelines of one to three business days.

Using current rates to boost short term cash

Short‑term money has a job: stay safe and remain available. Earning a few percentage points while it waits is a bonus.

At 3.25% APY, $10,000 nets about $325 in a year before taxes. Double the balance, double the dollars. That return won’t fund retirement, but it does offset inflation and helps your emergency fund slowly replenish itself after a small expense.

One caveat: HYSA rates can move. Don’t chase every tiny increase. Pick a reputable institution that stays competitive and revisit every few months.

Set it and move on – helps to build financial security in 2026 for you and your financial needs.

Best places to park idle cash and short term goals

For money needed in the next one to three years, safety and access come first. Practical options include:

– High‑yield savings accounts for everyday emergency reserves and near‑term goals.

– Money market deposit accounts from banks or credit unions for similar safety with check‑writing in some cases.

– Short‑term U.S. Treasury bills purchased directly or through a brokerage, with clear maturity dates and strong credit backing.

Many people split the difference: keep one to two months of expenses in checking, hold most of the buffer in a HYSA, and use a small ladder of short‑term Treasuries for funds needed on specific dates. That way, cash is accessible without sitting idle.

Roth IRA fundamentals for tax smart growth

After tax contributions and tax free compounding explained

A Roth IRA is funded with after‑tax dollars. You contribute money you’ve already paid taxes on, invest inside the account, and qualified withdrawals of contributions and earnings come out tax‑free.

Eligibility depends on earned income and falls under IRS income phase‑out ranges. Contribution limits adjust periodically with inflation. Confirm the current year’s limits and whether you qualify before setting up automatic transfers.

Two rules matter: the age 59½ rule and the five‑year rule. Generally, earnings are tax‑ and penalty‑free if the account has been open at least five tax years and you’re 59½ or older. Contributions, however, can be withdrawn at any time without taxes or penalties, since you already paid tax on them. That flexibility makes a Roth IRA unusually forgiving compared with other retirement accounts.

Tax‑free compounding over decades is powerful. It keeps more of your returns working.

A decades long growth snapshot

Consider steady investing rather than one‑time bets. If you invest $7,000 per year for 30 years at a 7% average annual return, the future value lands near $660,000. Increase the contribution or time horizon, and the numbers rise sharply.

This isn’t a promise; market returns vary and some years will be rough. The point is persistence. Automatic, periodic contributions capture more up markets than down, and time smooths volatility.

Start sooner if you can. Even small amounts matter early.

Roth IRA versus taxable brokerage in plain terms

In a taxable brokerage account, dividends and interest are taxed the year you earn them, and realized capital gains face tax when you sell at a profit. For many households, long‑term capital gains fall around 15% at the federal level, plus potential state taxes. That ongoing tax drag can reduce compounding.

Inside a Roth IRA, qualified gains and dividends avoid taxation entirely. Imagine holding a stock that grows to $1.5 million over decades. In a Roth IRA, qualified withdrawals are tax‑free. In a taxable account, you could owe tens or hundreds of thousands in taxes depending on your basis and tax bracket.

That’s a stark difference. It’s why many long‑term growth dollars belong in a Roth first.

Building a dependable emergency fund

How much to aim for based on expenses

A reasonable target is three to six months of essential expenses. Count housing, utilities, groceries, transportation, insurance, and minimum debt payments. If your income is less predictable or you support dependents, lean toward six to twelve months.

Don’t let the final number intimidate you. Build it in stages. First $1,000. Then one month. Then three months. Repeat deposits until you hit your target.

Small progress beats perfect timing.

Where to keep the fund for immediate access

Placement matters. Emergency funds work best in a HYSA or a money market deposit account at an insured bank or credit union. The goals are safety, liquidity, and a reasonable yield.

A simple structure:

– Keep a few hundred to one month of expenses in checking for instant access.

– Park the bulk in a HYSA to earn interest and reduce spending temptation.

– Link accounts so you can transfer quickly if needed.

Avoid tying emergency money to market risk or early withdrawal penalties. This pot is for resilience, not return.

Psychological benefits and flexibility during surprises to hinder your ability to build financial security in 2026

An emergency fund turns a $300 vet bill into an inconvenience, not a crisis. It keeps a flat tire off your credit card at 20% APR. It lets you handle a surprise bill, then calmly refill the bucket.

There’s another benefit: choice. With cash on hand, you can wait for the right job offer, relocate, or handle a family issue without fire‑selling investments. That peace of mind is hard to quantify and very real.

You sleep better.

Bringing the three moves together

How high yield savings Roth IRAs and emergency reserves work as a system to help build financial security in 2026

Each piece has a role. The HYSA handles short‑term needs and planned purchases. The emergency fund lives inside that HYSA to shield you from life’s speed bumps. The Roth IRA carries your long‑term growth plans and shields the gains from future taxes.

Cash buffers reduce the odds of selling investments at a bad time. Tax‑free growth accelerates the compounding that builds wealth. Together, they reduce stress and keep your plan intact during both calm and stormy periods.

Simple, resilient, repeatable.

Prioritizing contributions when money is tight

A practical order can help:

1) Build a starter emergency fund of $1,000 to $2,500 quickly.

2) Begin automatic Roth IRA contributions, even if modest.

3) Grow the emergency fund to three months of expenses.

4) Increase Roth contributions over time.

5) Add to HYSA for specific short‑term goals.

If cash flow is very tight, consider alternating months: one month to HYSA, the next to the Roth. Consistency matters more than perfection.

A focused action plan for 2026

Open the right accounts and automate contributions

– Choose a reputable online bank or credit union for your HYSA. Confirm FDIC or NCUA insurance and a competitive APY.

– Open a Roth IRA at a low‑cost brokerage. Set up automatic monthly contributions aligned with your eligibility and limit.

– Link your checking, HYSA, and Roth IRA. Schedule transfers right after payday so saving happens before spending.

Name your accounts for clarity: “Emergency Fund,” “2026 Vacation,” “Roth IRA.” Labels guide behavior.

Common mistakes to avoid and easy fixes

– Letting cash sit in near‑zero‑yield accounts. Fix: move to a HYSA and set recurring transfers.

– Mixing emergency money with daily spending. Fix: separate accounts with clear labels.

– Overtrading inside a Roth. Fix: choose diversified funds and rebalance on a schedule, not a whim.

– Ignoring Roth eligibility rules. Fix: check income limits, consider a different account if you exceed them.

– Chasing teaser APYs with constant account hopping. Fix: pick a consistently competitive bank and review quarterly.

– Forgetting tax forms. Fix: collect 1099‑INTs for taxable interest; Roth IRAs usually don’t create annual tax reporting unless you withdraw.

Small fixes prevent bigger headaches.

Simple checkpoints to stay on track

– Monthly: confirm automatic transfers executed.

– Quarterly: verify HYSA APY is still competitive; adjust if it lags.

– Twice yearly: revisit emergency fund size as expenses change.

– Annually: review Roth contributions, increase by a small amount, and check beneficiary designations.

Short reviews, big payoff. Check out Building Wealth for the Future: Your Path to Financial Prosperity

Next steps after the basics

Asset allocation and low cost investing to consider

Inside the Roth IRA, match investments to your time horizon and risk tolerance. Many long‑term investors rely on broad index funds that track the total U.S. stock market, global stocks, or a blend of stocks and high‑quality bonds. Expense ratios matter; the lower they are, the more return you keep.

A simple starting point is a target‑date index fund or a two‑fund mix: one broad stock index and one bond index. Keep it boring and automatic. Document your target percentages and rebalance on a set schedule.

Staying adaptable as rates taxes and rules change

Interest rates shift. Tax brackets and contribution limits get updated. Providers adjust features and fees. Review your setup once or twice a year, confirm you’re still eligible for your Roth target, and keep your HYSA competitive.

Adjust without overhauling everything. The core idea remains: keep short‑term money safe and earning, let long‑term money grow tax‑free, and maintain a cushion to handle life’s surprises.

Simple works in 2026. And beyond.

Stay Up To Date with the latest News, Blog Posts, Tips and Training...