Getting Ready For 2026 and Beyond

Health and Insurance

Learn about the best in your health as well as insurance needs

We make it simple to live healthier and protect what matters. Our service combines practical, science-informed wellness guidance with clear, unbiased insurance education so you can build better habits and choose coverage that fits your life and budget.

Our goal is to help you in achieving optimal health and securing the right insurance coverage are essential for a happy and fulfilling life. Our dedicated services are designed to empower you with the knowledge and tools necessary to make informed decisions about your well-being and financial protection.

What We Offer: A Comprehensive Approach to Health and Insurance

For most people, money comes with a lot of baggage. Raised on phrases like “money doesn’t grow on trees,” we tend to see it as scarce or even a source of stress. But what if money could become a steady, supportive part of your life? By helping you reshape your narrative, we’re here to shift that view so you can see it as a tool—an ally that, when handled right, brings more freedom and fewer worries.

Learn How to Be More Healthy

We provide actionable tips, evidence-based advice, and practical strategies to improve your overall health. From nutrition and exercise to stress management and preventative care, we'll equip you with the tools you need to live a healthier life.

Live a Healthy Life

We don't just tell you what to do; we help you integrate healthy habits into your daily routine. We offer resources and support to help you stay motivated and make lasting lifestyle changes.

Discover the Best Insurance Plans to Fit Your Needs and Budget

Navigating the insurance landscape can be overwhelming. Our experts will guide you through the different types of health insurance plans, explain the benefits of each, and help you find the coverage that best suits your individual needs and financial situation.

Health and Insurance for a Prosperous Lifestyle

Building a Prosperous Lifestyle is hard if one injury, illness, or unexpected bill can wipe out months of progress.

You should build a mindset that Health and Insurance for a Prosperous Lifestyle is really about protecting your body, your income, and your long-term plans—so you can keep moving forward even when life gets expensive.

Why Health and Insurance are the Foundation of Prosperity

A prosperous lifestyle isn’t only about earning more—it’s about keeping what you earn. Medical costs are one of the fastest ways to create debt, drain savings, and force tough trade-offs like skipping rent, falling behind on loans, or delaying important goals.

When you prioritize Health and Insurance for a Prosperous Lifestyle, you reduce the financial shock of emergencies and give yourself the stability to invest, save, and plan confidently. Think of insurance as a guardrail: you hope you never need it, but you’re grateful it’s there when the unexpected happens.

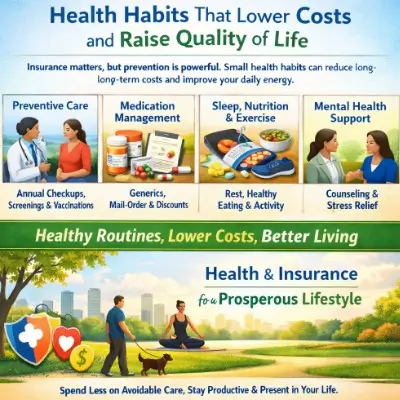

Health Habits That Lower Costs and Raise Quality of Life

Insurance matters, but prevention is powerful. Small health habits can reduce long-term costs and improve your daily energy—both of which support a prosperous lifestyle. Focus on high-impact basics: preventive care (annual checkups, screenings, and vaccinations when covered), medication management (ask about generics, mail-order options, and discount programs), sleep/movement/nutrition (consistent routines reduce avoidable health issues), and mental health support (counseling and stress management protect relationships and work performance).

Pairing healthy routines with Health and Insurance for a Prosperous Lifestyle helps you spend less on avoidable care while staying productive and present in your life.